Horizon ERP Tutorial

Transactions

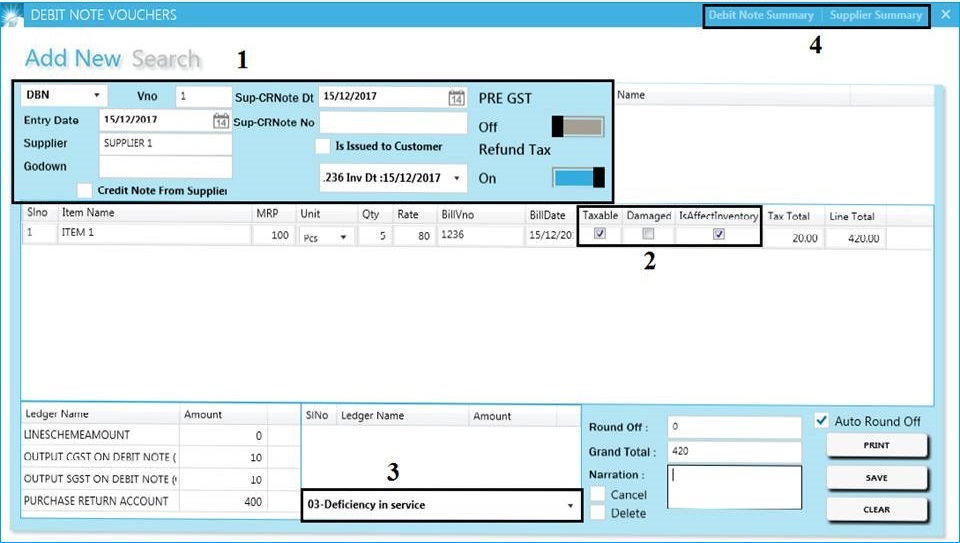

Debit Note(Purchase Return)

Debit note is a commercial document issued by a buyer to a seller as a means of formally requesting a credit note.Debit note acts as the Source document to the Purchase returns journal.

- Series : Select the series.

- Entry Date : Input entry date.

- Supplier : Select supplier name.

- Sup- CRNote Dt : Input the Sup- DbNote Dt, if the supplier give their debit note date and tick debit note from supplier.

- Sup- CRNote No : Input the Sup-DbNote Dt, if the supplier give their debit note number and tick debit note from supplier.

- If it is a GST debit note , Turn off "Pre-GST" and Turn on "Refund tax".

- If it is a Non GST debit note Turn on "Pre-GST" and Turn off "Refund tax".

- Invoice no. : Select invoice no.

- Item field :

- If Refund tax on , Item listed based on the selected invoice number.

- Keep the returned item and delete all other items in the entry.

- If Pre-GST on, Press F5 in item field for list all items.

- Taxable : Tick for adding tax component.

- Damaged : Tick to show the item is damaged.

- Is Affect Inventory : If tick, affect the stock of entered item.

- Select the reason for purchase return (Applicable for GST filing).

- Debit note summary

- Supplier Summary